ESG (Environment, social and governance) started in 2009 with the Ministry of Corporate Affairs, Government of India, issuing the National Voluntary Guidelines on Corporate Social Responsibility Section 135 of company's act ,2013.

"ESG" represents Environmental, Social, and Governance. Presently it has likewise turned into a rule for monetary examination of any organization. These days, investors are more educated, and they remember this data for their investigation prior to going with any venture choice.

This assists them with giving a superior comprehension of the organizations they are wanting to invest in. Aside from the financial elements, financial investors have additionally begun non-monetary variables for their risk management and better opportunities.

There are ESG Rating Agencies giving rating to every one of the organizations with the goal that investors can put resources into the companies which has high ESG rating.

Sustainalytics ESG Risk Ratings, MSCI ESG Ratings, Bloomberg ESG Disclosures Scores Etc. are some of the trust worthies providing ESG rating.

In an arising nation like India, participating in an ESG subject will permit more organizations to be ESG-consistent, which will prompt practical development for people in the future and add to abundance creation for the two organizations and partners. As a matter of fact, in India, the Nifty ESG 100 record has conveyed equivalent or a bigger number of profits than more extensive Nifty files, very much like its worldwide companions on a highlight point and moving premise.

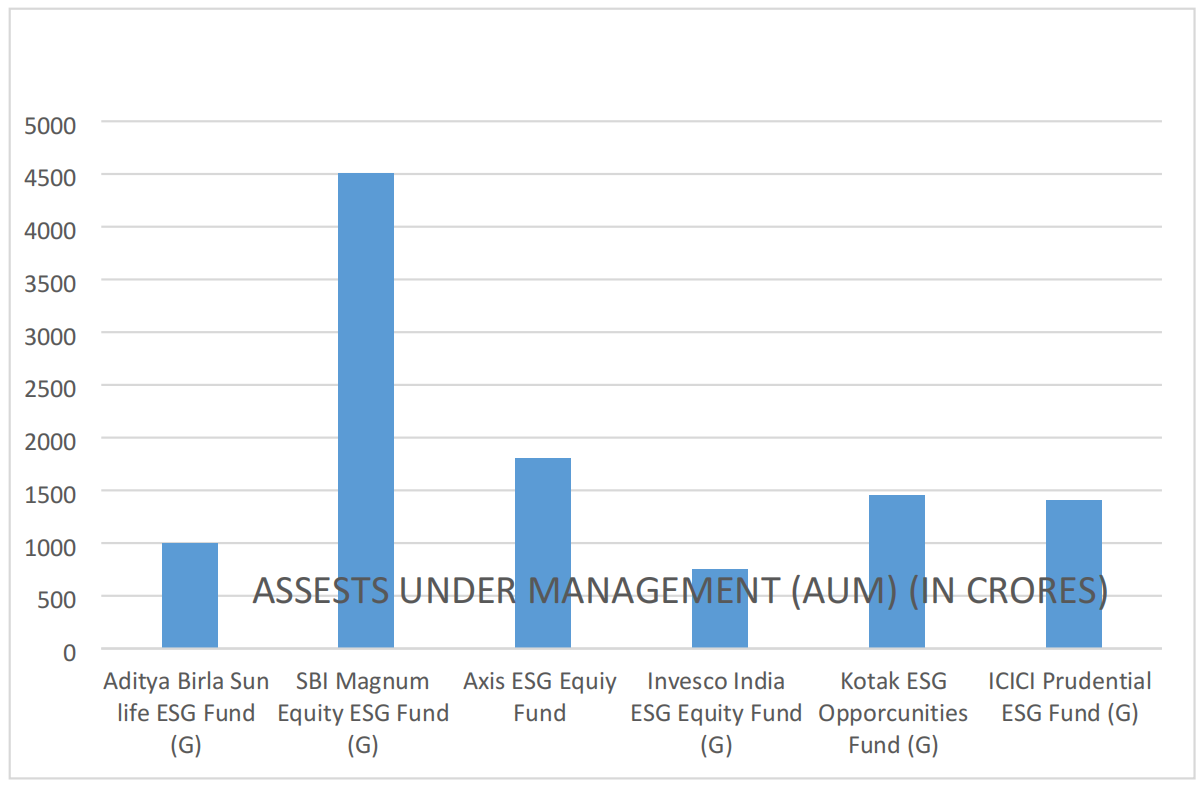

ESG funds are funds that dispense their major portion in stocks of companies that are evaluated on the basis of environmental, social, and governance factors. These organizations are profoundly reasonable in their activities and providing adequate returns to investors. SBI Magnum Equity ESG Fund with an asset base of Rs 3,518 crore is the oldest ESG Fund in India.

Economical assets outflanked customary friend reserves and diminished venture risk during Covid in 2020, as per the Morgan Stanley Institute for Sustainable Investing.

https://www.etmoney.com/blog/what-are-esg-funds-should-you-invest-in-them/15.9.2022

The organizations with higher ESG scores should be chosen. One ought to consider the organizations which are effectively playing out their corporate social obligation. Then, at that point, the organizations which are making a positive social effect in the public eye ought to be given the honor and have solid corporate administration and morals. Aside from this, the financial backer ought to search for reserves that proposition lower cost proportions and those that have no lock-in time or leave load.

There is no single expert on ESG scores since they are determined by various organizations utilizing the diverse methodology. Most providers list specific ESG measurements, for example, the effect of environmental change and political commitments. Be that as it may, these pointers fluctuate broadly.

The strategies by which providers get information differed also. MSCI ESG Exploration, one of the main free makers of ESG appraisals, involves information from organization filings as well as government, college, and non-administrative association data sets.

MSCI ESG ratings are a comprehensive measure of a company's long-term commitment to socially responsible investments (SRI) and environmental, social, and governance (ESG) investment standards. In particular, the MSCI ESG ratings focus on a company's exposure to financially relevant ESG risks.

ESG reserves try not to put resources into inherently damaging firms to the climate or society since they center around the three mainstays of ecological, social, and administration supportability. Tobacco, betting, and firearm producing organizations are only a couple of models. Financial backers should peruse the plan related documentation for conspire explicit subtleties since there are no common principles regarding the matter.